Financial Modelling ExampleInvestment Financial Model

Capital Investment Financial Model (DCF)

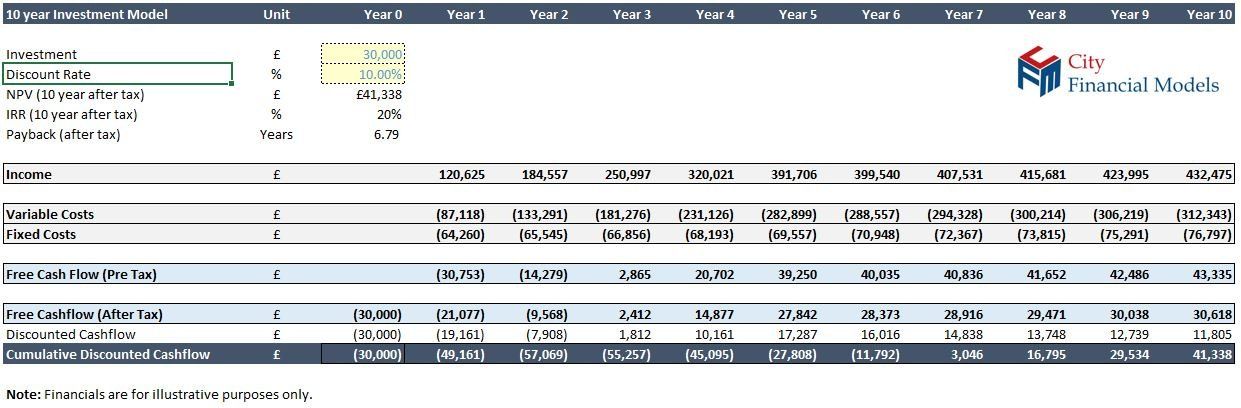

A discounted cashflow (DCF) capital investment financial model is used to evaluate investment decisions such as the purchase of another company or investing in new equipment or a new site.

The financial model will generate the future cashflows of the potential investment, which is then discounted.

The cashflow will generally include the quantification of any synergies, opportunity costs or erosion associated with the project.

The resulting net cashflow can be analysed with a firms preferred metric, i.e. NPV, IRR, payback or discounted payback to determine if it is an opportunity worth pursuing.

See some of our work examples:

With our experience in developing complex DCF - discounted cashflow capital investment financial models in Excel, our London financial modelling consultancy is a responsive and competitive solution to your financial modelling needs.

We provide quality real world financial modelling solutions, without the complex engagement process or overheads of a Big 4 and are a great alternative to hiring an interim financial modeller.

Contact us

to see how we can help your organisation develop a robust and reliable DCF financial model.