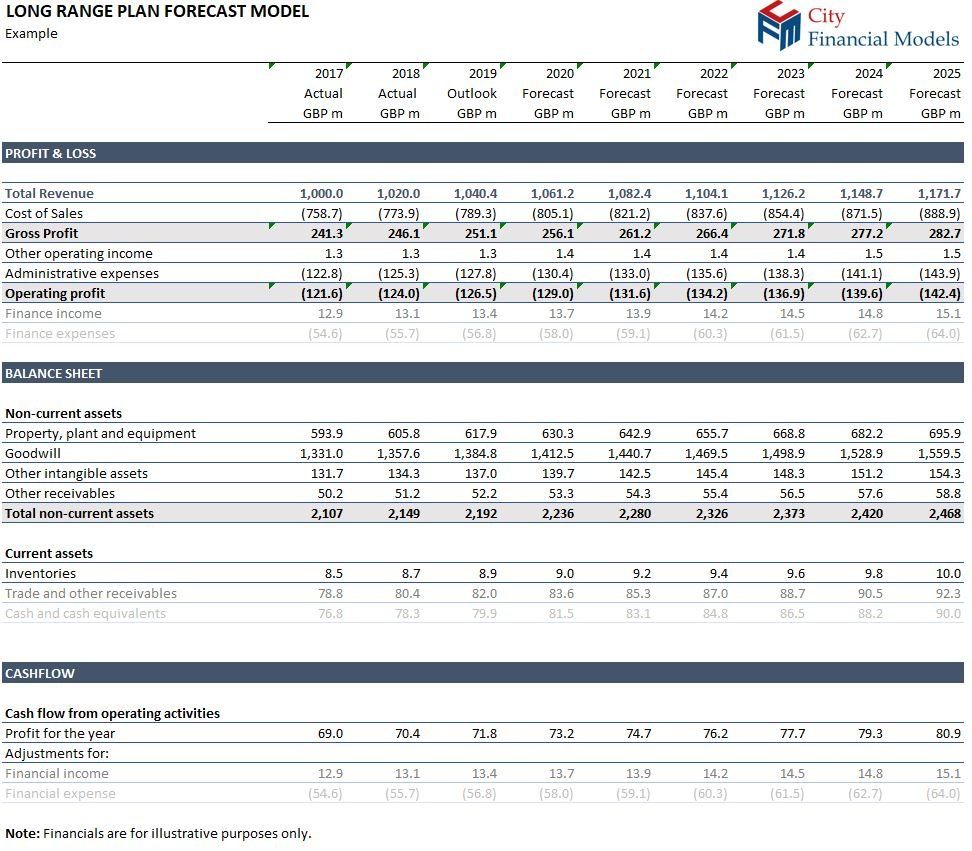

Financial Modelling ExampleLong Range Plan Financial Model

Long Range Plan Financial Model

Client:

Downstream oil company with both retail and commercial operations.

Project:

To create a detailed multi-site long range forecast financial model. The business had a number of distinct retail and commercial operations which needed to be modelled in differently.

Reason for new model:

The company had recently been purchased by new owners and the current forecast financial model was deemed to high level to support the management reporting process.

Inputs:

System trial balances for historical data and current year budget. Forecast revenue and expense data was supplied by the relevant operational division through excel templates.

Structure:

Monthly, 5 years history, current year budget, current year forecast, 10 year forecast.

Outputs:

Profit and Loss (Pro forma & as acquired), Balance Sheet, Cashflow, Capex Schedule. Covenant schedule.

Challenges:

Bulk oil purchases had particularly complex cash timing. In addition, the different operations had quite different operating models and as the company was restructuring, the model needed to be flexible enough to accommodate a fluid business structure.

With our experience in developing multi site long range plan models in Excel within a range of industries, our London financial modelling consultancy is a responsive and competitive alternative to hiring an interim financial modeller.