Financial Modelling Example Long Range Plan Financial Model

Long Range Plan Forecast Financial Model

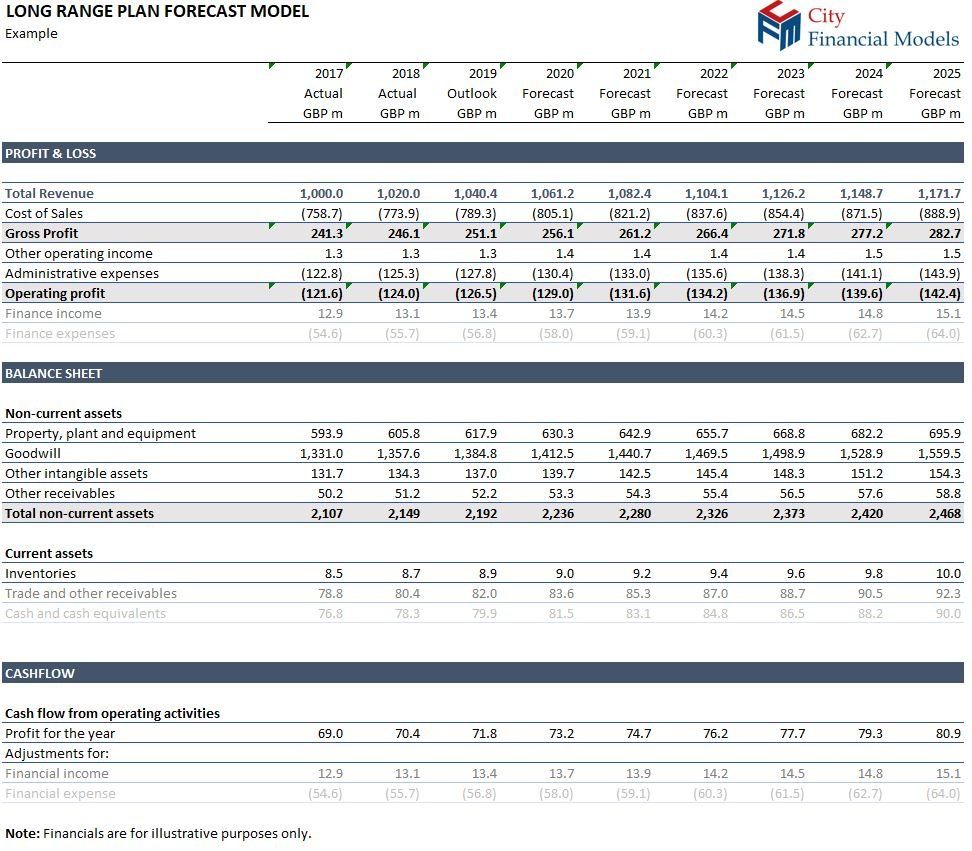

This type of financial model supports a firm’s long term strategic plan.

Generally, the main financial model outputs are the standard financial statements:

- profit & loss (Income statement)

- balance sheet

- cashflow

The model will generally include static historical data and forecast data based on a number of market and key business drivers. Depending on the industry, the forecast years can range from 3 to 30 years.

In order to model the future years, the model will use a number of assumptions or key forecast drivers such as:

- macro - such as inflation, tax rates.

- market - size of market and potential growth in the market.

- company - projected volume of sales and value of sales, variable and fixed costs.

From the key assumptions, the future years are extrapolated and can be shown with the historical data (either on a pro-forma or as acquired basis). The model will generally include a facility to run different scenarios based on different business outlooks.

With our experience in developing complex long range plan financial models in Excel, our London financial modelling consultancy is a responsive and competitive solution to your financial modelling needs.

We provide quality real world financial modelling solutions, without the complex engagement process or overheads of a Big 4 and are a great alternative to hiring an interim financial modeller.

Contact us

to see how we can help your organisation develop a robust and reliable long range plan financial model.