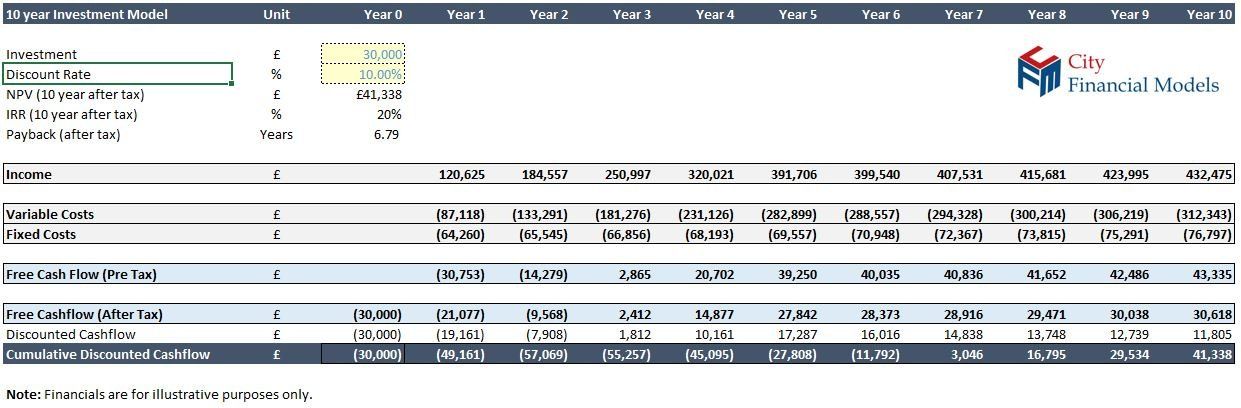

Financial Modelling ExampleDCF Investment Financial Model

Capital Investment Financial Model

Client:

Multi national, multi site international entertainment company.

Project:

To build a generic capital investment financial model for group use.

Reason for new model:

With the recent growth in the company size, there became a need to formalise the capital expenditure evaluation process.

Inputs:

Templates for capital costs, revenue and expenditure.

Structure:

5 year forecast revenue and expenditure cashflow.

Outputs:

Net Cashflow, NPV, IRR and Payback.

Challenges:

To make the model flexible enough to accommodate all potential group capital expenditure projects, yet have sufficient detail to support board papers seeking funding approval.

With our experience in developing complex capital investment financial models in Excel within a range of industries, our London financial modelling consultancy is a responsive and competitive alternative to hiring an interim financial modeller.