Financial Modelling ExampleProperty Pro Forma Financial Model

Property Pro Forma Financial Model

Client:

London Property Developer

Project:

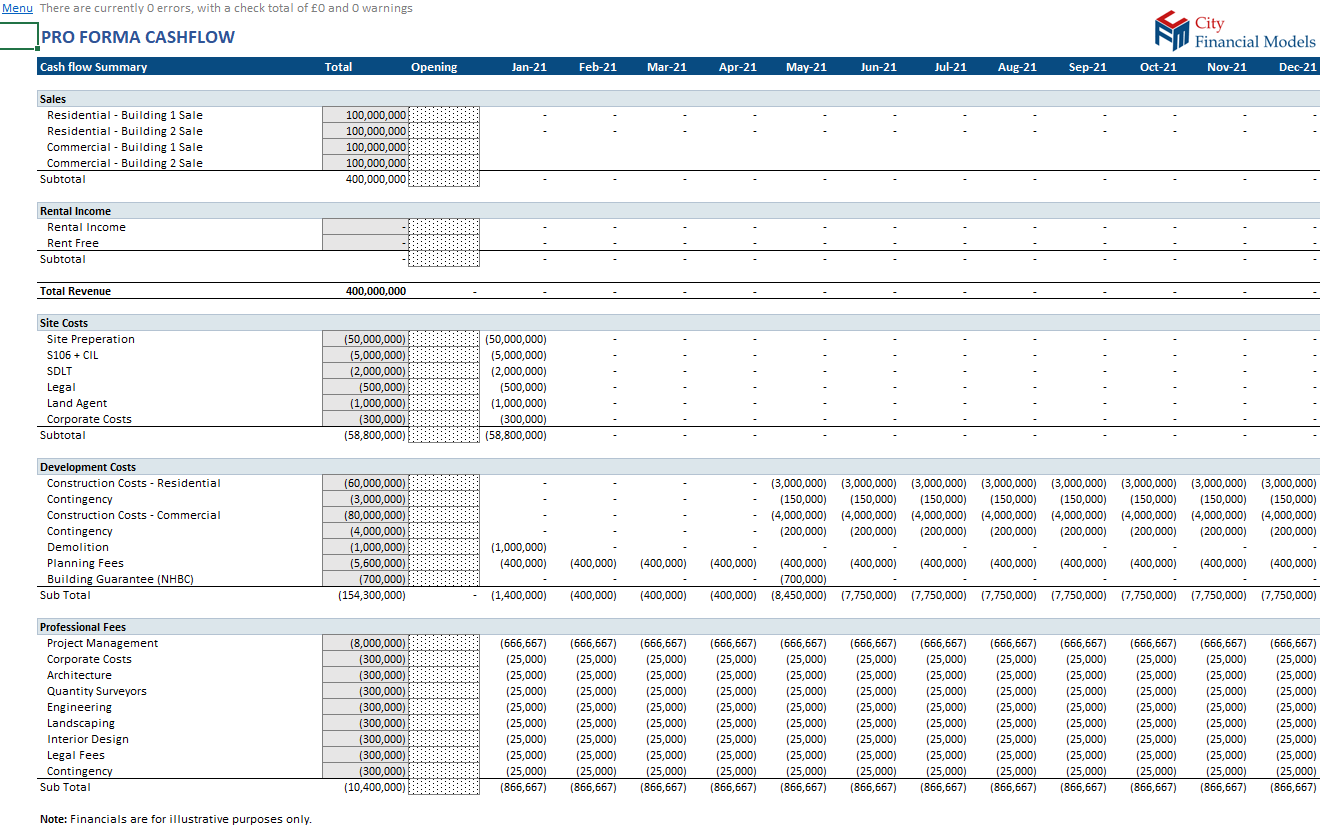

Model to evaluate the investor and developer returns for a potential mixed use development in London.

Reason for new model:

To evaluate the returns to the developer and investors using different allocation methods and hurdle rates.

Inputs:

Development and build costs, funding details, rent and yield expectations.

Structure:

2 year construction period, 7 years operations

Outputs:

Key facts summary

Sources and uses summary

Investor returns waterfall

Pro forma cash flow

Dashboard

Funding summary

Challenges:

There were a lot of changes to the waterfall returns structure, so we included all the potential options, with/without IRR hurdles, ROI hurdles, all with 2 or 3 tier options.

With our experience in developing complex property financial models in Excel within a range of industries, our London financial modelling consultancy is a responsive and competitive solution to your financial modelling needs.

We provide quality real world financial modelling solutions, without the complex engagement process or overheads of a Big 4 and are a great alternative to hiring an interim financial modeller.

Contact us

to see how we can help your organisation develop a robust and reliable property financial model.